The regulation on the modernisation of financial statements applies to financial years beginning on or after 1 January 2025.

1.Implementation of ANC regulation 2022-06

a. Context

The regulation on the modernisation of financial statements was published in the Official Journal on 30 December 2023.

The 5 main changes are as follows:

- the elimination of the expense transfer technique

- the new definition of exceptional items

- changes to the chart of accounts

- a reduction in the number of financial statement models

- a new presentation in the notes to the financial statements

ANC regulation 2022-06 applies to industrial and commercial companies (as well as investment firms, insurance companies, cooperatives, agricultural companies, private not-for-profit entities, social housing bodies and joint professional bodies).

b. Objectives:

- Facilitate the digitisation of companies’ annual accounts;

- To update the accounting models and the chart of accounts in order to revise the existing models to make them more appropriate to the real situation;

- Simplify these models to facilitate comparisons between companies by standardising the presentation of financial statements.

2. Exceptional items and expense transfers

a. The new definition of exceptional items

The new definition of exceptional items proposed by the French National Accounting Board (ANC) is based on a conceptual definition (major and unusual event) to which must be added a limited list of items that must be included.

A major event: when its consequences are likely to have an influence on the judgement that users of the summary documents may make about the assets and liabilities, financial position and results of the entity, as well as on the decisions that they may have to take.

Unusual event: an event that is not related to the normal and current operation of the entity. An event is presumed to be unusual when it has not occurred in recent accounting periods and is unlikely to recur in future accounting periods.

The ANC mentions, by way of example, that an expropriation, a cyber-attack or a natural disaster are events likely to meet the conditions for classification as major and unusual events.

In particular, the following items must be included under exceptional items:

- accounting entries that are purely tax-based (for example, accelerated depreciation)

- changes in accounting methods recorded in the income statement

- corrections of errors

Income and expenses directly linked to a major and unusual event will be those that would not have been recognised in the absence of this event. Grants, reimbursements and indemnities directly linked to the major and unusual event and received as compensation for operating expenses will be classified as operating income.

The CNOEC (Conseil National de l’Ordre des Experts-Comptables) makes an observation in its technical note, indicating that the future rules do not provide for the possibility of allocating an expense partly to ordinary income and partly to extraordinary income (for donations or bad debts in particular).

A tax or social security audit cannot be considered as a major and unusual event. The consequences of social or tax audits will, therefore, be recognised in profit or loss from ordinary activities (with certain exceptions).

In the case of a ‘significant customer dispute’ or a ‘write-off of a current account with a financial recovery clause’, if the event is considered to be of a major and unusual nature, it should be presented as an exceptional item.

ANC regulation 2022-06 changes the treatment of items that were previously recognised as exceptional items, by now including them in operating income, which affects the amount of profit-sharing. If a profit-sharing agreement takes into account current profit or operating profit, the amount of profit-sharing will also be affected by this new definition.

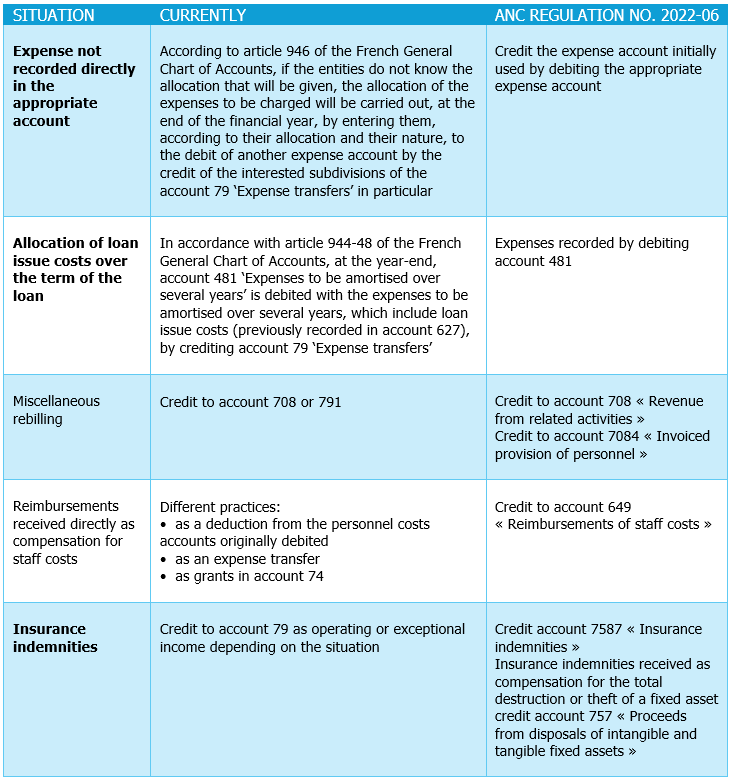

b. Elimination of the expense transfer technique

ANC regulation 2022-06 eliminates the expense transfer technique in order to facilitate the analysis of financial statements. Various situations are explained by the ANC in order to compensate for the elimination of this technique:

The abolition of the expense transfer technique is therefore likely to have an impact on the amount of the special profit-sharing reserve.

3. Modernisation of financial statements

The new chart of accounts is made up of straight-line accounts, whose use is compulsory, and italicised accounts, whose use is optional. However, entities retain the option of opening any necessary subdivision if the accounts provided for in the accounting standards are not sufficient for their needs. This means that the subdivisions of the current chart of accounts, even those that have been deleted, can still be used.

The National Council has drawn up a table comparing the current chart of accounts and the future chart of accounts. Click here to consult the PCG

This table highlights several changes:

- 150 accounts (approximately) have been deleted

- 150 accounts (approximately) have had their name or account number changed

- around ten new accounts have been created

This revision of the chart of accounts has the following consequences:

- the deletion of the levels of accounts of the developed system and the abbreviated system appearing in the current PCG, in order to maintain only one chart of accounts ;

- accounts whose purpose has become obsolete or whose level of granularity seems too fine are also deleted.

Exceptional items will be presented in the income statement (basic and abbreviated systems) as total exceptional income and expenses for the year.

Exceptional items must now be disclosed in the notes to the financial statements.

This requires a description in the notes of the income and expenses recognised as exceptional items.

For each major and unusual event that gives rise to the recognition of income and expenses under exceptional items, the following should be provided in the notes to the financial statements: a description of the event, the amounts already recognised in previous years and the nature of the income and expenses recognised in the current year.

This article was written in March 2025. Please note that this analysis is applicable as of today and does not take into account any potential changes, the data is subject to change.