Capital gain on sale :

Until now, one of the major assets of furnished rentals resided in the calculation of the resale capital gain of the property. Indeed, unlike the other regimes, the owner of a non-professional furnished rental (LMNP) could depreciate his property and thus create a charge reducing his taxation for 20 years, based on the value of his property and furniture. And do so, without these deducted depreciations ever being taken into account in the calculation of the capital gain generated on the sale of the said property.

From January 2025 onwards, when a property that has been rented furnished and depreciated is sold, this depreciation that has been previously deducted must be added to the sale price for the calculation of the capital gain. This will result in an increase in the amount of the taxable capital gain matching the total amount of depreciation applied during the furnished rental activity.

Micro regimes:

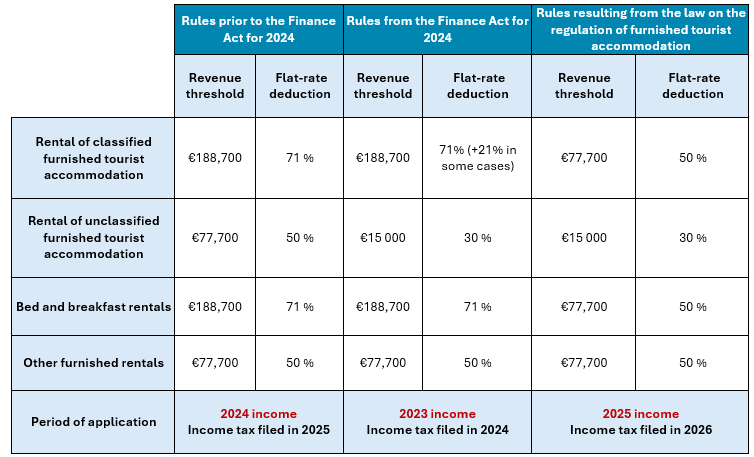

In the absence of any content regarding the micro regimes in the Finance Act for 2025, it is the law of November 2024 aimed at regulating furnished tourist rentals that is to be applied. It adjusts the micro BIC regime to align the rules for the taxation of classified furnished tourist accommodation and bed and breakfast accommodation with the regime for other furnished rental activities, thus tightening them.

To do this, the turnover threshold for furnished tourist accommodation and bed and breakfast will be reduced from €188,700 to €77,700 and the flat-rate deduction will be lowered from 71% to 50% with the disappearance of the additional 21% allowance for rural areas from 2025 income and followings.

Summary table with the periods of application and specificities of each set of rules :

This article was written in February 2025. Please note that this analysis is applicable as of today and does not take into account any potential changes, the data is subject to change.